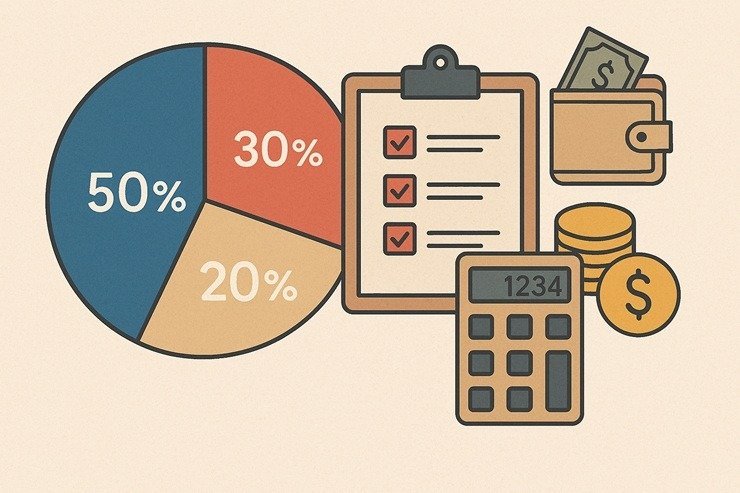

The 50/30/20 rule is an easy but highly effective budgeting technique that helps you handle your cash properly. By dividing your earnings into wants, needs, and financial savings, it creates a balanced monetary plan that’s straightforward to observe and preserve.

Managing your funds doesn’t should be overwhelming. In truth, with only a little bit of construction, you may achieve extra management over your spending, begin saving smarter, and scale back monetary stress. One of many easiest and simplest budgeting strategies is the 50/30/20 rule—a rule that breaks down your earnings into simply three classes. Whether or not you’re simply beginning out with budgeting or in search of a clearer option to deal with your cash, this technique is a superb place to start.

Let’s break it down.

What Is the 50/30/20 Rule?

Contents

The 50/30/20 rule is a budgeting guideline that helps you divide your after-tax earnings into three broad classes:

- 50% for Wants

- 30% for Desires

- 20% for Financial savings and Debt Reimbursement

It’s a versatile, beginner-friendly framework that prioritizes each monetary accountability and way of life enjoyment. It was popularized by U.S. Senator Elizabeth Warren in her ebook All Your Price: The Final Lifetime Cash Plan.

Calculate Your After-Tax Revenue

Earlier than making use of the 50/30/20 rule, you could work out your web earnings—that’s what you are taking dwelling after taxes, insurance coverage, and retirement contributions (if these are robotically deducted out of your paycheck).

For instance, in case your month-to-month wage is $4,000 after taxes, that’s the quantity you’ll base your finances on.

50% for Wants

The primary class is the necessities—bills you could pay to dwell and work. This takes up 50% of your earnings.

What counts as a “want”?

- Lease or mortgage funds

- Utility payments (electrical energy, water, web, and many others.)

- Groceries (fundamental meals objects, not takeout or snacks)

- Transportation (gasoline, public transit, automobile funds)

- Medical insurance and medical bills

- Minimal mortgage funds

- Important childcare or training prices

These are the non-negotiables. If you happen to discover that your wants exceed 50% of your earnings, you could must discover methods to chop again—like discovering cheaper housing or decreasing utility prices—or increasing your income if attainable.

30% for Desires

Subsequent up: the enjoyable stuff. The 30% “needs” class is all about way of life selections and non-essentials. These are issues that enhance your high quality of life however aren’t strictly mandatory.

Examples of “needs” embody:

- Eating out and ordering in

- Streaming subscriptions (Netflix, Spotify, and many others.)

- Searching for garments or devices

- Holidays and journey

- Health club memberships (except medically mandatory)

- Hobbies and leisure

It’s essential to be sincere with your self. A every day $5 espresso may really feel like a necessity, nevertheless it’s truly a need. Being conscious right here permits you to take pleasure in life whereas keeping spending under control.

20% for Financial savings and Debt Reimbursement

That is the class that builds your monetary future. The ultimate 20% of your earnings goes towards financial savings, investments, and paying off debt past minimal funds.

This consists of:

- Emergency fund contributions

- Retirement financial savings (401(ok), IRA, and many others.)

- Mutual funds or inventory investments

- Further funds towards bank cards or pupil loans

- Saving for a house, automobile, or future objectives

If you happen to don’t have an emergency fund but, that needs to be your first precedence—purpose for not less than 3–6 months’ value of important bills. As soon as that’s in place, you may give attention to rising your wealth and changing into debt-free sooner.

Why the 50/30/20 Rule Works

It’s Easy

You don’t want difficult spreadsheets or monetary levels to observe this rule. It’s straightforward to recollect and apply.

It’s Balanced

In contrast to excessive budgeting strategies, the 50/30/20 rule permits room for enjoyable and self-care whereas nonetheless specializing in monetary objectives.

It’s Adaptable

This rule could be adjusted to fit your way of life. As an illustration, in case your “wants” are solely 40%, you should use the additional 10% to spice up financial savings or spend extra on experiences.

When the Rule Would possibly Not Work

Whereas the 50/30/20 rule is nice for a lot of, it could not swimsuit everybody.

- If you happen to dwell in a metropolis with a excessive value of dwelling, your “wants” might exceed 50%.

- If you happen to’re aggressively paying off debt or saving for a significant purpose, you may must allocate greater than 20% to financial savings.

- Freelancers or these with fluctuating earnings may want a extra dynamic budgeting technique.

In such instances, use the rule as a place to begin and tweak the odds to suit your scenario.

The way to Get Began

- Monitor your present bills. Use a spreadsheet, budgeting app, or easy pocket book to see the place your cash goes.

- Categorize your spending. Divide your bills into wants, needs, and financial savings.

- Examine with the 50/30/20 rule. Are you overspending in any space?

- Alter the place mandatory. In the reduction of on needs or reevaluate your must release cash for financial savings.

- Automate your financial savings. Arrange automated transfers so your 20% goes straight into financial savings/funding accounts.

A Fast Instance

Let’s say you are taking dwelling $5,000 a month:

- $2,500 (50%) for Wants: Lease, groceries, transportation, payments

- $1,500 (30%) for Desires: Consuming out, subscriptions, hobbies

- $1,000 (20%) for Financial savings/Debt: IRA, emergency fund, further mortgage cost

This construction offers you a strong basis to handle cash responsibly with out sacrificing the whole lot you take pleasure in.

Ultimate Ideas

Budgeting doesn’t should be worrying or overly restrictive. The 50/30/20 rule provides a transparent, versatile option to handle your funds and prioritize what really issues. By understanding where your money is going and making small, intentional changes, you may construct a safer and fulfilling monetary future—one finances at a time.